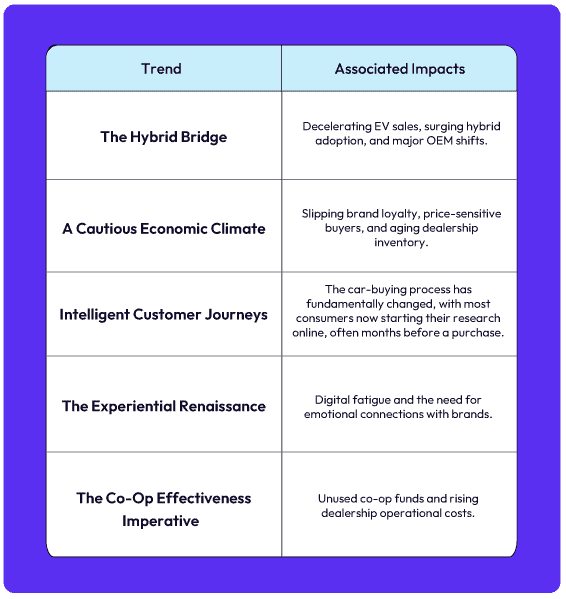

01. Introduction

The primary narrative is one of strategic adaptation.

The 2026 automotive marketing landscape is poised for a significant transformation, moving beyond a singular, technology-driven narrative toward a more pragmatic, consumer-centric paradigm. This shift is characterized by a delicate balance: leveraging cutting-edge digital intelligence to meet customers where they are, while simultaneously building authentic, emotional connections to combat digital fatigue. The market is not undergoing a radical transformation but rather a course correction, guided by evolving consumer preferences, a cautious economic climate, and an increasingly complex regulatory environment. The strategic imperative for OEMs in 2026 is to embrace this duality, balancing traditional with digital, physical with virtual, and brand-level messaging with local, dealer-specific communications.

Success in 2026 will not be measured by the adoption of any single technology or trend, but by the ability to synthesize these diverse elements into a cohesive, consumer-centric strategy.

02. The Hybrid Bridge

The Trend: Hybrids Ascendant, EVs Realigned

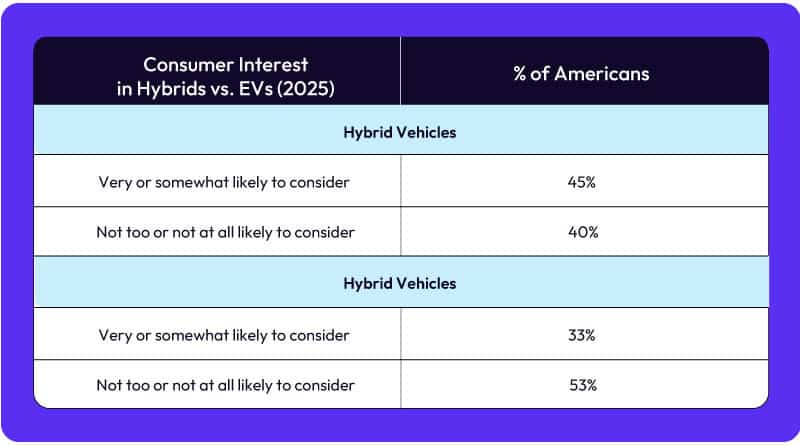

The single most significant market force reshaping automotive marketing for 2026 is the profound course correction in the push toward electrification. A once-unwavering narrative of an all-electric future is now giving way to a more pragmatic, consumer-driven reality. Evidence from the first quarter of 2025 demonstrates a marked slowdown in the growth of new retail electric vehicle (EV) registrations, which settled at 7.8%, a slight decline from the 7.9% recorded a year prior. In stark contrast, hybrid vehicle registrations surged to 13.6% in the same period, continuing a strong upward trajectory from 11.3% in 2024 and 8.8% in 2023. By the end of 2024, hybrids accounted for approximately 60% of all electrified vehicle sales in the U.S., a testament to their overwhelming popularity. [1,3]

This trend is not a rejection of electrification itself, but rather a profound market signal favoring flexibility, affordability, and practicality. According to the Deloitte 2025 Global Automotive Consumer Study, consumer interest in all-battery electric vehicles (BEVs) is described as “muted” in most markets, including the U.S. In contrast, there is a “growing interest in hybrid and range extender technologies,” which are seen by consumers as a “best of both worlds” solution. [2]

Strategic Implications: The Pursuit of Affordability

Consumer sentiment toward electric vehicles is not a monolithic force, but a complex interplay of economic realities and psychological perceptions. A closer look reveals a significant divide between the confidence of existing owners and the hesitation of prospective buyers, a gap that is being strategically addressed by automakers through innovative marketing and product positioning.

This opens new messaging opportunities, allowing brands to re-center their campaigns around affordability, reliability, and consumer choice — qualities that a significant portion of the market, particularly those seeking commercial trucks and SUVs, still values deeply.

Marketing to the Trend

Marketing should highlight the affordability, superior fuel efficiency, and “no compromise” performance of hybrid models, directly addressing the cost-conscious consumer. Leveraging targeted, cross-channel campaigns, especially on platforms like Connected TV (CTV), allows for the delivery of compelling, tier-one-style video content that can be localized with dealer-specific callouts and QR codes that link directly to local inventory. This approach leverages the power of household-level targeting to reach the entire decision-making unit involved in a car purchase. Furthermore, sales teams should be trained to confidently sell a multi-powertrain portfolio, addressing customer concerns about charging, maintenance, and long-term value for both hybrids and EVs.

Table Source: https://www.pewresearch.org/science/2025/06/05/americans-interest-in-purchasing-electric-and-hybrid-vehicles/

03. A Cautious Economic Climate

The Trend: Slipping Brand Loyalty, Price-Sensitive Buyers, and Aging Dealership Inventory

Consumers in the U.S. are approaching auto purchases with increased caution due to the current economic climate. Key factors influencing their behavior include elevated inflation, high interest rates, and rising vehicle prices, conditions exacerbated by new tariffs and ongoing economic uncertainty. These pressures have led to widespread concerns about affordability, with 68% of consumers worried they will overpay for their next vehicle and 72% expecting tariffs to make vehicles less affordable. As a result, many are delaying purchases, especially if a new vehicle is not an immediate necessity, and are extending the life of their current vehicles, which now average over 12 years of use. [4]

In August 2025, the average new-vehicle transaction price (ATP) was $49,077, and the average manufacturer’s suggested retail price (MSRP) was $51,099. The upward trend is being driven by the growing popularity of high-end vehicles, particularly full-size pickups with new powertrain options. [6]

In parallel, brand loyalty among new-vehicle owners has slipped. The J.D. Power 2023 U.S. Automotive Brand Loyalty Study found that as new-vehicle inventory and sales rebound, buyers have more choices and are less likely to remain loyal to a specific brand. The study found that even the highest loyalty rate, 64.6% for Ford trucks, represents a significant opportunity for conquesting. A key factor behind this erosion of loyalty is a lingering frustration from the post-pandemic era. Supply chain disruptions forced consumers to keep their vehicles for longer than normal, which led to a higher incidence of problems. As a result, many of these buyers are now looking to switch brands and are less inclined to reward their previous manufacturer with repeat business.

Strategic Implications

The decline in new vehicle gross profits, which has been persistent for over two years, places the traditional dealership business model under immense pressure. In this environment, the strategic imperative for dealerships is to focus on a holistic view of the customer’s lifetime value rather than a single, one-off transaction. While overall dealer profitability has declined, certain profit centers have remained resilient and even grown. Fixed Operations (service, parts, and body shop work) and the F&I department have proven to be reliable sources of income that can offset losses on the front end of new vehicle sales. [7]

The rising popularity of CPO vehicles is not just a market response but a strategic move by OEMs and dealers to preserve brand loyalty and sales volume in a high-priced market. By offering well-maintained, one-year-old CPO units, brands can simplify the buying process for consumers and keep them within the brand’s ecosystem, with the long-term hope that they will eventually upgrade to a new vehicle. This approach turns the affordability challenge into an opportunity to build a long-term customer relationship. [8]

Marketing to the Trend

Consumers are cautious right now and need clear, confidence-building communication that emphasizes practical benefits like long-term savings, fuel efficiency, and lower maintenance costs. The CPO market should be actively promoted as a viable alternative for new-car buyers, with messaging that emphasizes the warranty and certified quality that make the vehicle feel “close enough to new”. Additionally, marketing should actively promote flexible financing options, including longer loan terms and the willingness to work with customers who have past credit issues, as this directly addresses the core financial anxieties of the target audience. Most importantly, the sales process for both new and used vehicles must be transparent and frictionless, as building trust is a critical component of marketing in an uncertain economic environment.

04. Intelligent Customer Journeys

The Trend: From Funnels to Fluidity: Journeys Redefine Customer Engagement

The traditional linear sales funnel is becoming obsolete, replaced by an intelligent, real-time, and data-driven customer journey. This shift is powered by hyper-personalization, which is no longer a competitive advantage but a foundational element of modern automotive innovation. The goal is to move beyond broad segmentation to deliver consistent, relevant, and responsive interactions that feel like a trusted partnership rather than a transaction. This is achieved through a combination of AI, machine learning, and anticipatory intelligence that responds dynamically to user behavior, preferences, and even their mood. [9]

The vehicle itself is transforming into a “digital moving platform,” seamlessly integrated into the customer’s daily life through applications and connectivity. This connection allows for continuous, value-driven interactions that extend far beyond the initial sale. AI-powered systems can now provide personalized route suggestions, adjust in-car settings based on driver habits, and even send proactive service reminders before a problem is noticed. This level of constant engagement, driven by data, transforms the brand-customer relationship into a continuous, two-way dialogue that fosters deeper brand loyalty and creates new revenue streams for OEMs. [10]

Strategic Implications

The investment in AI, machine learning, and Customer Data Platforms (CDPs) is not a marketing expense; it is a foundational operational necessity that directly impacts dealer efficiency and profitability. In a world where the deprecation of third-party cookies is reshaping digital advertising, a dealership’s first-party data (e.g., service records, website interactions, test drive information) is becoming its most valuable asset. Unifying this data across all touchpoints — dealership visits, online interactions, app usage, and vehicle telemetry — in a single CDP creates a complete, 360-degree view of the customer. [10]

This unified data stream serves as the lifeblood for an intelligent customer journey. AI-driven systems can analyze this data to perform predictive analytics and lead scoring. By assigning a score to each lead based on their likelihood to convert, the AI can prioritize high-value prospects, allowing the sales team to focus their efforts on those most likely to purchase a vehicle. This automation directly addresses a significant industry problem: the average dealer response time of 9.2 hours, which is far too slow given that buyers often make a decision within 48-72 hours of initial contact. [11]

Marketing to the Trend

AI should act as a trusted guide throughout the entire customer journey, online and in the dealership, by delivering personalized, confidence-building interactions. This includes tailored vehicle recommendations based on browsing history, proactive service reminders informed by vehicle telemetry, and customized financing options aligned with individual profiles. In the dealership, AI-powered tools such as chatbots and virtual assistants can provide instant, transparent support, ensuring a seamless, frictionless experience that feels helpful rather than transactional.

05. The Experiential Renaissance

The Trend: Beyond the Showroom, Crafting Authentic, Shareable Brand Experiences

The car buying journey is evolving from a product-centric transaction into a captivating, immersive experience that resonates with new generations of buyers who prioritize authenticity and connection. This “Experiential Renaissance” is leveraging a fusion of digital tools and physical events to go far beyond the traditional showroom. Millennials and Gen Z are not just buying cars; they are buying into a lifestyle and an emotional connection with a brand. This is reflected in their expectations for seamless digital interactions and a preference for experiences over physical possessions. These events are designed to be “shareable” and bring about user-generated content, which is a key form of social proof for a generation that is skeptical of traditional advertising. [12]

Strategic Implications

For dealerships and automakers, the strategic imperative of this trend is to build a lasting, authentic relationship with the next wave of car buyers. Since younger consumers are adept at spotting inauthentic marketing, brands must shift their focus from hard-sell tactics to creating memorable, intentional moments. The return on investment (ROI) is not solely transactional; it is also relational, measured by the social amplification and brand loyalty that these experiences generate. [13]

Marketing to the Trend

Audiences are moving past purely digital engagement and increasingly crave authentic, in-person activations to discover and connect with brands and services. Campaigns should spotlight the emotional connection and lifestyle a vehicle enables, rather than just product features. Authenticity is key — employee-generated content and real customer stories resonate far more than polished ads. Brands can create memorable experiences beyond the showroom, such as community events like free car washes or car seat safety clinics, to foster trust and belonging. Maintaining brand oversight is essential for ensuring every experiential initiative aligns with the overarching brand mission, delivering consistency and authenticity across all touchpoints.

06. The Co-Op Effectiveness Imperative

The Trend: Turning Dollars into Data

While co-op marketing — a strategic partnership where OEMs share the cost of advertising with their dealers — offers significant benefits like cost reduction and increased brand awareness, the traditional model is often inefficient and lacks accountability. Many agencies push generic strategies that fail to account for the unique complexities of the automotive sales cycle and the intricate requirements of both the OEM and the local dealer. The new imperative is a shift from a focus on simply funding activities to a data-driven approach that links co-op spend directly to measurable outcomes and tangible distribution in brand-aligned channels.

The primary flaw in the traditional model is a lack of transparency and a focus on process over results. The system is often designed for a brand to receive a funding request and then manually “figure out how that request has contributed to increased sales.” This is an inefficient approach that leads to misallocation of funds and a breakdown in accountability. The solution lies in leveraging advanced marketing analytics and Partner Relationship Management (PRM) platforms to automate fund management, track performance in real-time, and ensure that every dollar spent is tied to a specific business objective.

Strategic Implications

Optimizing co-op effectiveness is more than a financial exercise; it is a critical driver of the OEM-dealer relationship. By implementing an automated, data-driven system, OEMs can provide clear transparency into available funds, simplify program rules, and offer ongoing support to their partners. This streamlined process directly addresses a key source of friction and frustration for dealers, whose satisfaction with the program is directly linked to its efficiency and ease of use. The ability to automate claim submission and reimbursement not only saves time but also strengthens the partnership by demonstrating that the OEM is invested in the dealer’s success.

Marketing to the Trend

Brands should regularly evaluate their co-op programs and how they position value to dealers and partners, ensuring funds are directed toward channels that activate the strategic levers the brand intends. By aligning co-op investments with high-ROI, data-driven tactics brands can deliver precision, relevance, and measurable impact, reinforcing both dealer success and the overarching brand strategy.

Sources

- Experian: “Auto: Fueling the Shift – Hybrids Continue to Gain Momentum” (https://www.experian.com/blogs/insights/auto-fueling-the-shift-hybrids-continue-to-gain-momentum/)

- Deloitte: “2025 Global Automotive Consumer Study” (https://www.deloitte.com/global/en/Industries/automotive/perspectives/global-automotive-consumer-study.html)

- Digital Dealer: “Hybrid Learning: What the Rise of Hybrid Vehicles Can Teach Us About Flexibility in Automotive Marketing” (https://digitaldealer.com/news/hybrid-learning-what-the-rise-of-hybrid-vehicles-can-teach-us-about-flexibility-in-automotive-marketing/166523/)

- Mintel: “Car Purchasing Process 2025” (https://clients.mintel.com/content/report/car-purchasing-process-us-2025#workspace_SpacesStore_addc2d47-a719-4e3f-8257-f5dd581d48a1)

- Exploding Topics: “6 Top Advertising Trends to Watch (2025 & 2026)” (https://explodingtopics.com/blog/advertising-trends)

- Automotive Fleet: “2026 MY Vehicle Prices Rise Across The Market” (https://www.automotive-fleet.com/10247120/2026-my-vehicle-prices-rise-across-the-market)

- Haig Partners: “Dealership Profits Decline in 2024: What It Means for the Future” (https://haigpartners.com/resources/dealership-profits-decline-in-2024-what-it-means-for-the-future/)

- Auto Remarketing: “COMMENTARY: Why 1-year-old certified pre-owned vehicles are trending” (https://www.autoremarketing.com/ar/analysis/commentary-why-1-year-old-certified-pre-owned-vehicles-are-trending/)

- Citrin Cooperman: “Mastering Customer Journeys with Next-Gen Marketing Automation” (https://www.citrincooperman.com/In-Focus-Resource-Center/Mastering-Customer-Journeys-with-Next-Gen-Marketing-Automation)

- SoftClouds: “Crafting Hyper-Personalized Customer Journeys in Automotive Industry” (https://www.softclouds.com/blogs/crafting-hyper-personalized-customer-journeys-in-automotive-industry.html)

- TECOBI: “The Role of AI in Automotive Lead Generation: Smarter, Faster, and More Efficient” (https://www.tecobi.com/the-role-of-ai-in-automotive-lead-generation-smarter-faster-and-more-efficient/)

- Moment: “Experiential Trends for 2026” (https://www.madebymoment.com/blog/experiential-trends-for-2026)

- Actual SEO Media: “Empower Automotive Marketing Through Reaching Gen Z” (https://actualseomedia.com/empower-automotive-marketing-through-reaching-gen-z/)